Here we have a sector and industry, there Leading indicators contracting and nonstop job cuts happening for the last 5 months.

Let’s have a look at Retail- wholesale in the Automotive parts industry. There are few stocks you would like to consider “short” just looking at the fundamentals.

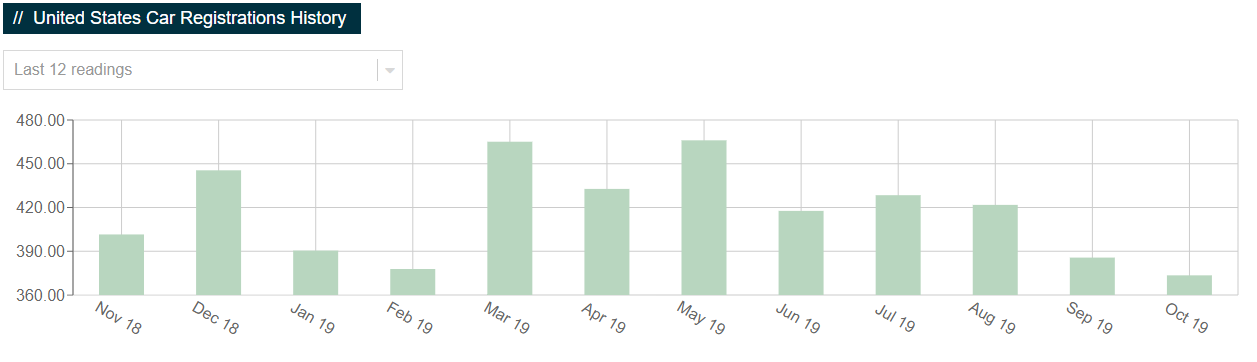

Where do I begin? Car Registrations in USA falling since July 2019. Car sales is one of the unspoken indicators to measure economy’s strength indicator.

Let’s go to “the biggest stock market merchant”- USA and have a look at what we think is the worst companies in this Consumer Cyclical industry:

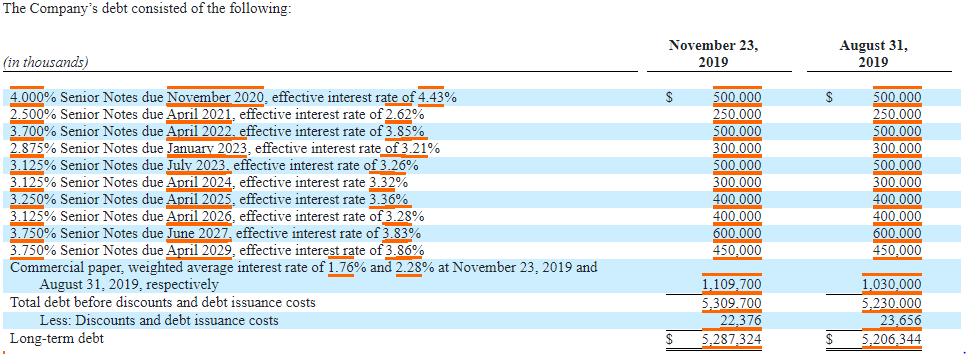

AutoZone (AZO) – It has the most debt. Current liabilities and long-term debt interest piling up, until it will be unbearable:

Insiders selling like mad while institutions holding nearly 98% of stock shares, as soon they will start dump this one it will be free fall. It has only 11% international exposure. Cash is burning for the last 3 years. Cash flow from investing activities hovering around -$500m Quarter over Quarter since 2012, they’re making bad decisions and wasting money for the last 7 Years!!!

Some of the management insights found in latest 10-Q:

“The Company is involved in various legal proceedings incidental to the conduct of its business, including, but not limited to, several lawsuits containing class-action allegations in which the plaintiffs are current and former hourly and salaried employees who allege various wage and hour violations and unlawful termination practices. While the resolution of these matters cannot be predicted with certainty, management does not currently believe that, either individually or in the aggregate, these matters will result in liabilities material to the Company’s Condensed Consolidated Statement of Income, Condensed Consolidated Balance Sheet or Condensed Consolidated Statement of Cash Flows.”

“Our business is somewhat seasonal in nature, with the highest sales generally occurring during the months of February through September and the lowest sales generally occurring in the months of December and January.”

| AZO | Industry | S&P 500 | |

| 5‑Day Return | -2.0% | -0.2% | 0.6% |

| 1‑Month Return | 1.7% | 1.6% | 3.2% |

| YTD Return | 43.4% | 19.2% | 31.7% |

| 1‑Year Return | 42.6% | 19.9% | 32.7% |

| 3‑Year Return | 49.7% | 13.9% | 51.2% |

| 5‑Year Return | 94.4% | 16.9% | 71.3% |

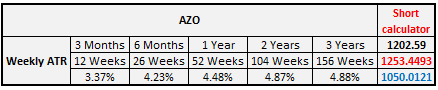

Average True Range:

If you open short position on December 27th closing stock price, you should put stop loss at $1253.44 with target price at $1050.01 for some 3 to 6 months holding short position

Let’s not forget- AZO released earnings nearly two weeks ago, the price might consolidate for a while until it picks up direction.

CarMax (KMX) – Short float is over 12.5%, somethings not right, let’s have a look in it deeper:

| KMX | Industry | S&P 500 | |

| 5‑Day Return | -4.60% | -1.60% | 0.60% |

| 1‑Month Return | -10.10% | -2.00% | 3.20% |

| YTD Return | 40.90% | 33.70% | 31.70% |

| 1‑Year Return | 39.90% | 35.50% | 32.70% |

| 3‑Year Return | 37.50% | 26.90% | 51.20% |

| 5‑Year Return | 30.70% | 18.60% | 71.30% |

Operating expenses growing by billion yoy and it produces just ~$40 m of operating income for the last 4 years in a row. Company is building up cash cushion. Cash position is better comparing to AZO and ORLY. Debt increasing for last 2 years. Company cut nearly 100m in investing activities, this might tell that industry doesn’t hold strong. YoY issuing new Senior Notes on high interest- desperate for money. In next two years they must pay out over 4.7b “debt under vehicle programs, including related party debt due to Avis Budget Car Funding”. Quite some money for the company with only 15b market cap to pay off one third of it just in next few years. But this is even better:

“At September 30, 2019, we had approximately $15.1 billion of indebtedness, including corporate indebtedness of approximately $3.5 billion and debt under vehicle programs of approximately $11.6 billion.”

Available borrowing capacity under committed credit facilities is just 3.3b, that’s very close to borrowing limits. This company’s net income has tendency to stay in cycle of first two quarters to have high net income while 3rd and 4th way lower. We are nearly in a middle of the next 3 to 4 month cycle for this company, if the market itself, doesn’t change its general direction.

Third quarter earnings released at a beginning of November 2019, and we’re waiting for annual release to have better view. At this moment we have to wait for any spikes and then short, but for those who can’t wait there might be a good idea to get one third short position with tight stop loss at $93 and target at $74.5 with one to three win ratio.

O’Reilly Automotive (ORLY) – has the biggest market cap and stock price appreciated the most of our three picks, massive 125% growth in last 5 years.

| ORLY | Industry | S&P 500 | |

| 5‑Day Return | -0.9% | -0.2% | 0.6% |

| 1‑Month Return | -1.9% | 1.6% | 3.2% |

| YTD Return | 27.0% | 19.2% | 31.7% |

| 1‑Year Return | 27.4% | 19.9% | 32.7% |

| 3‑Year Return | 54.1% | 13.9% | 51.2% |

| 5‑Year Return | 125.4% | 16.9% | 71.3% |

YoY issues new senior notes- pilling up debt. Forward looking P/E are contracting. It has highest EPS growth of the last 5 years. Cash only $42m. They have massive compensation schemes for board members, some cashed out almost $9m just before Christmas

“While we have historically realized operating profits in each quarter of the year, our store sales and profits have historically been higher in the second and third quarters (April through September) than in the first and fourth quarters (October through March) of the year.”

We should see annual earnings report very soon, we’ll get more insight into this one.

But for those who can’t wait to enter short position, here are targets: entering at today’s price you should put your stop loss at $456.6 and profit-taking at $379.15

End thoughts

- None of these pays dividends

- All three in a cyclical economy

- KMX has the best international exposure and most cash comparing to AZO and ORLY

- AZO has good “moat”, highest net income, most debt, most cash flow

- All three on a watchlist, for price spikes