While everyone thinking about Christmas and which major currency gonna perform better in 2020. so let’s try to go deeper in USD and JPY economic plants.

What we must look first at 2020.

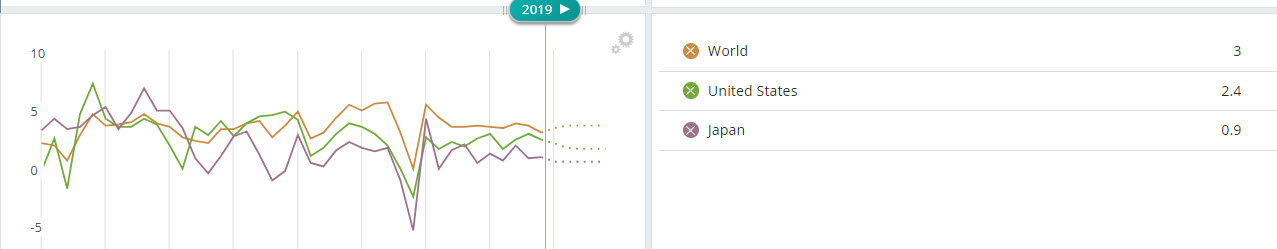

GDP (Gross domestic product) one of the indicators which could tell, how the economy will grow in coming 2020. As we can see in 2020 United States forecasts GDP will contracts at slower rate compared to Japan, differential between countries increase from 1.5% to 1.6% what gives us more expansion in US economy.

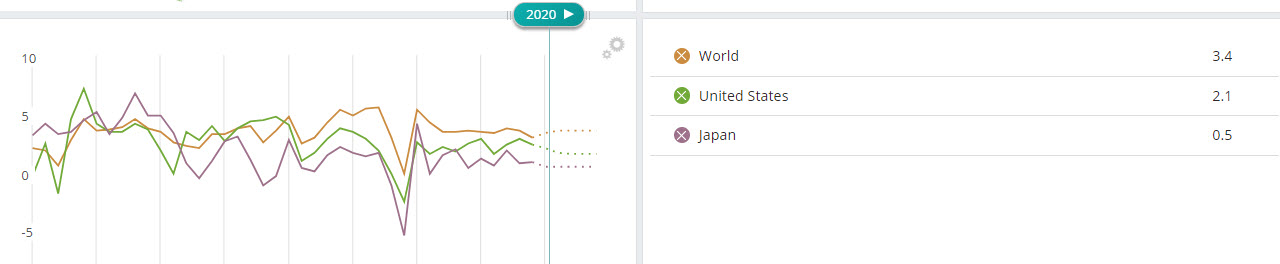

Second important factor in economy is export, what supports country’s economy.

- Vehicles: US$154.1 billion (20.9% of total exports)

- Machinery including computers: $148 billion (20.1%)

- Electrical machinery, equipment: $109.4 billion (14.8%)

- Optical, technical, medical apparatus: $41.3 billion (5.6%)

- Iron, steel: $29.9 billion (4.1%)

- Plastics, plastic articles: $26.1 billion (3.5%)

- Organic chemicals: $18.9 billion (2.6%)

- Mineral fuels including oil: $13.3 billion (1.8%)

- Ships, boats: $12.6 billion (1.7%)

- Gems, precious metals: $12 billion (1.6%)

An interesting fact that most of Japan export belong to the Car industry and 40% of total cars are sold in USA. It could also tell us what could affect Japan economy in the near future. According car registrations history since May 466K it contracted to 373K in sales, constant contraction could mean that customers do not want to spend money or they started to save it.

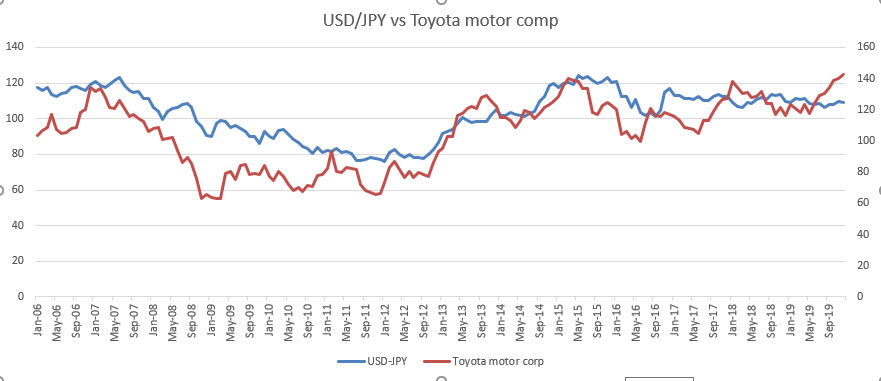

Toyota biggest car manufacturer in Japan, comparison company stock price and USD/JPY pair price could be the third thing to look at. According to history charts were a reflection of each other, in the last 3 months Toyota started an increase in faster rate which could affect countries’ economy and with cheaper yen, Japan could sell more cars to USA.

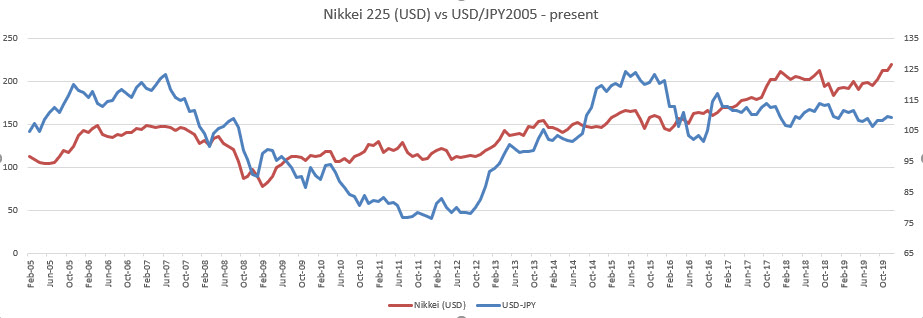

Last but not least indicator to look at is the major Japan index versus USD/JPY currency pair. Since 2016 rate between the price and index gap was widening for 3 years, at the moment we have situation where 2020 would be the third year of widening maybe would be a year where we could close the gap.

In conclusion, the US started strengthening in early-stage this is one of the most things which can not be seen through technical analysis or chart. TA is a leading indicator it’s good to enter to the positions for timing but not for currencies pair future expectation.