How far can interest rates fall?

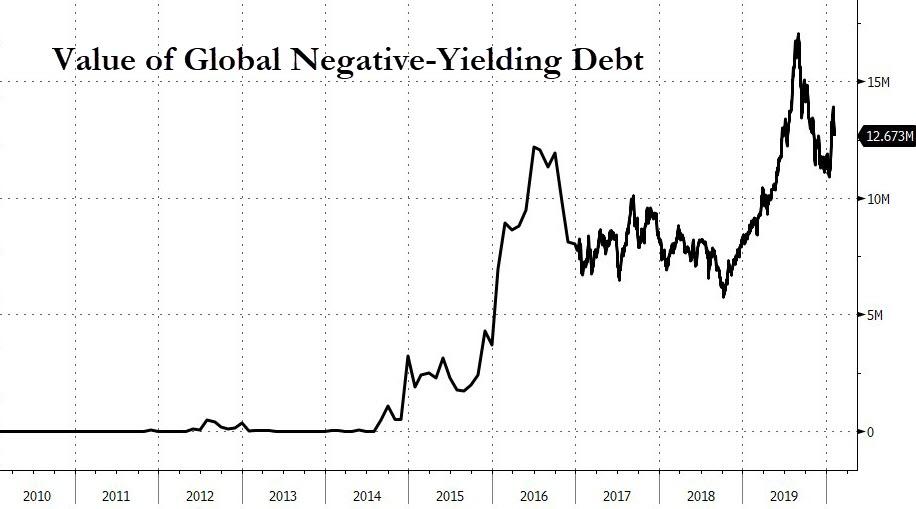

Currently, many sovereign rates sit in negative territory, and, as Visual Capitalist’s Dorothy Neufeld notes, there is an unprecedented $13 trillion in negative-yielding debt.

This new interest rate climate has many observers wondering where the bottom truly lies.

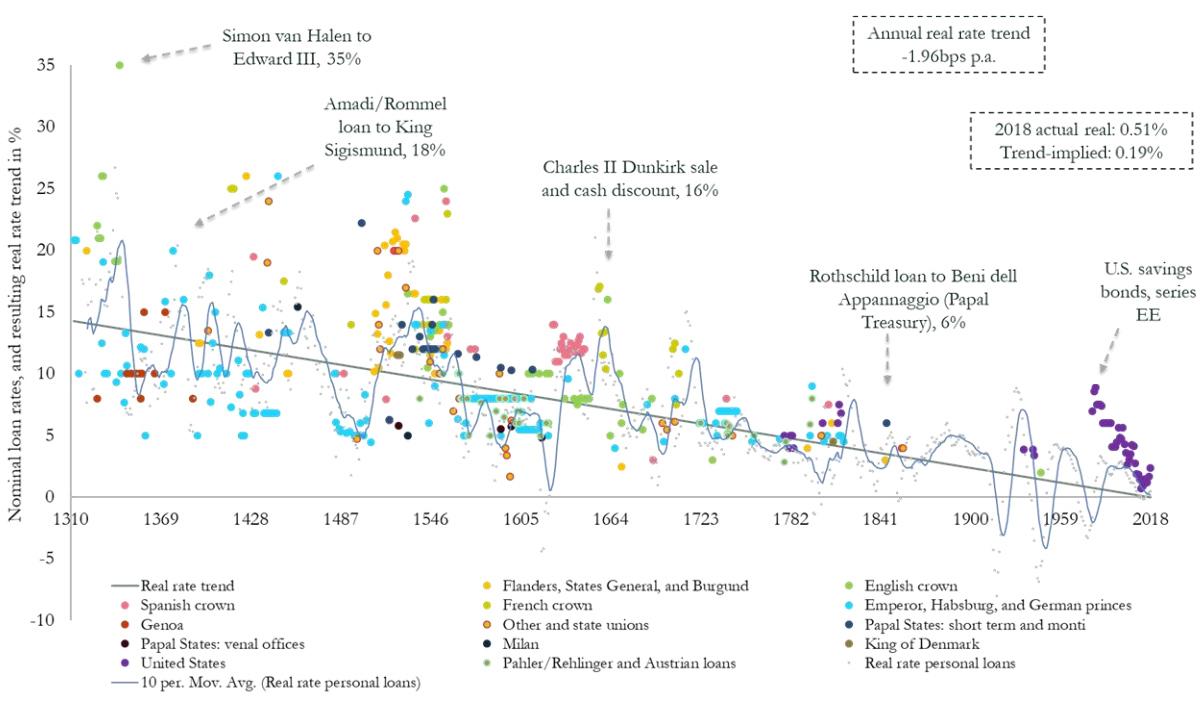

Today’s graphic from Paul Schmelzing, visiting scholar at the Bank of England (BOE), shows how global real interest rates have experienced an average annual decline of -0.0196% (-1.96 basis points) throughout the past eight centuries.

The Evidence on Falling Rates

Collecting data from across 78% of total advanced economy GDP over the time frame, Schmelzing shows that real rates* have witnessed a negative historical slope spanning back to the 1300s.

Displayed across the graph is a series of personal nominal loans made to sovereign establishments, along with their nominal loan rates. Some from the 14th century, for example, had nominal rates of 35%. By contrast, key nominal loan rates had fallen to 6% by the mid 1800s.

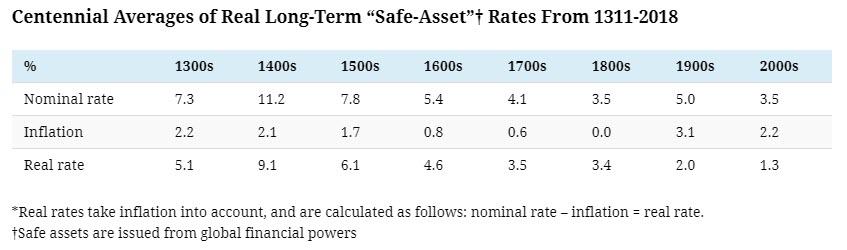

Starting in 1311, data from the report shows how average real rates moved from 5.1% in the 1300s down to an average of 2% in the 1900s.

The average real rate between 2000-2018 stands at 1.3%.

Current Theories

Why have interest rates been trending downward for so long?

Here are the three prevailing theories as to why they’re dropping:

1. Productivity Growth

Since 1970, productivity growth has slowed. A nation’s productive capacity is determined by a number of factors, including labor force participation and economic output.

If total economic output shrinks, real rates will decline too, theory suggests. Lower productivity growth leads to lower wage growth expectations.

In addition, lower productivity growth means less business investment, therefore a lower demand for capital. This in turn causes the lower interest rates.

2. Demographics

Demographics impact interest rates on a number of levels. The aging population—paired with declining fertility levels—result in higher savings rates, longer life expectancies, and lower labor force participation rates.

In the U.S., baby boomers are retiring at a pace of 10,000 people per day, and other advanced economies are also seeing comparable growth in retirees. Theory suggests that this creates downward pressure on real interest rates, as the number of people in the workforce declines.

3. Economic Growth

Dampened economic growth can also have a negative impact on future earnings, pushing down the real interest rate in the process. Since 1961, GDP growth among OECD countries has dropped from 4.3% to 3% in 2018.

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.

Larry Summers referred to this sloping trend since the 1970s as “secular stagnation” during an International Monetary Fund conference in 2013.

Secular stagnation occurs when the economy is faced with persistently lagging economic health. One possible way to address a declining interest rate conundrum, Summers has suggested, is through expansionary government spending.

Bond Yields Declining

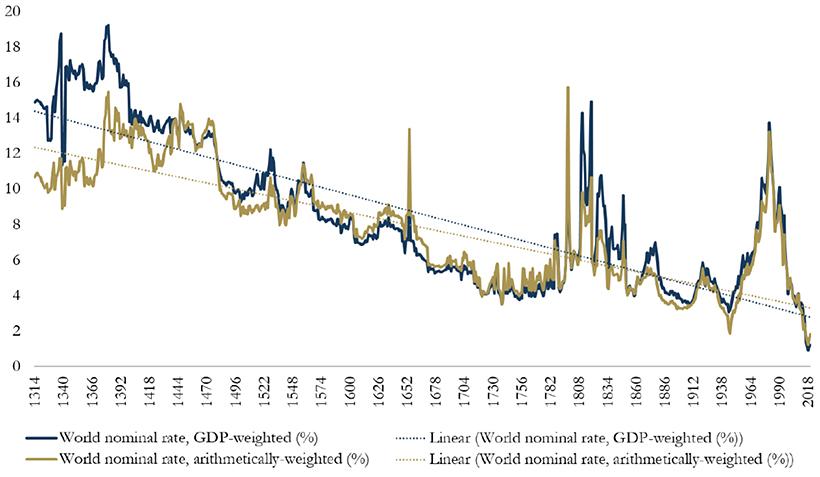

According to the report, another trend has coincided with falling interest rates: declining bond yields.

Since the 1300s, global nominal bonds yields have dropped from over 14% to around 2%.

The graph illustrates how real interest rates and bond yields appear to slope across a similar trend line. While it may seem remarkable that interest rates keep falling, this phenomenon shows that a broader trend may be occurring—across centuries, asset classes, and fiscal regimes.

In fact, the historical record would imply that we will see ever new record lows in real rates in future business cycles in the 2020s/30s

-Paul Schmelzing

Although this may be fortunate for debt-seekers, it can create challenges for fixed income investors—who may seek alternatives strategies with higher yield potential instead.